Acumen Pharmaceuticals is developing an Alzheimer’s disease drug that it believes offers advantages compared to other approaches—including the recently approved Biogen therapy. A small clinical trial is underway to potentially demonstrate those claims, and the company now has $160 million from its IPO to continue its research.

Acumen priced its shares at $16 apiece, the top end of the projected $14 to $16 per share price range. The Charlottesville, Virginia-based company was able to boost the size of the deal, offering nearly 10 million shares, up from 8.3 million shares it had previously planned. Those shares began trading on the Nasdaq Thursday under the stock symbol “ABOS.” Investors showed enthusiasm for Acumen’s approach, as its shares opened at $25 each, more than 56% higher than the IPO price.

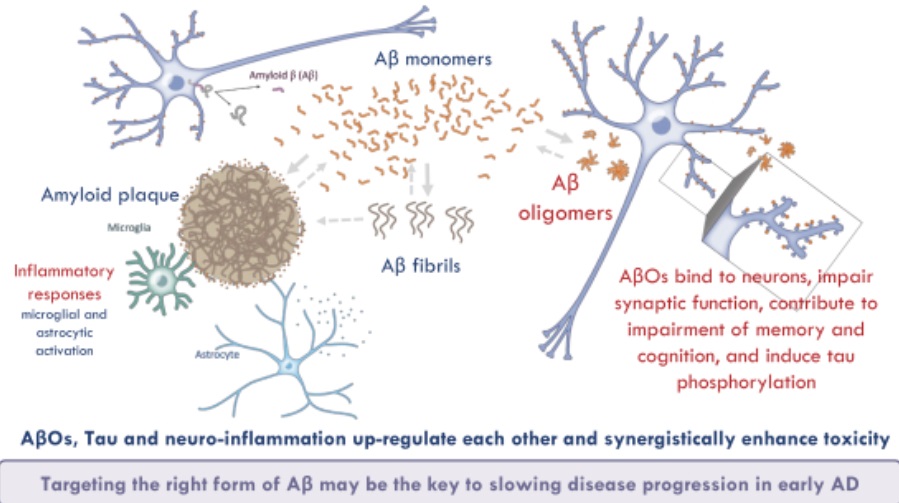

The research of Acumen follows on the so-called amyloid hypothesis, which posits that Alzheimer’s disease stems from the accumulation of beta amyloid protein into plaques in the brain. Drug developers have addressed these plaques with antibodies that aim to either break up the accumulation of the problem protein or target beta amyloid monomers, the form of the protein before it becomes pathogenic, the company said in the IPO filing. Most of those approaches have either failed to show efficacy or have been stymied by toxicity problems.

In a “refinement” of the amyloid hypothesis, Acumen says research has found at least three different forms of beta amyloid in the body. Acumen’s research focuses on soluble beta amyloid oligomers (AbOs), the form of amyloid protein that has clustered together. In the IPO filing, the company said it believes this form of amyloid is the most toxic and pathogenic form, causing toxicity in synapses as well as neurodegeneration. In animal research, accumulation of AbOs is associated with the deterioration and loss of synapses, the formation of tangles of tau protein, and inflammation. Acumen adds that this form of amyloid is associated with behavioral defects, including learning and memory impairment.

“In light of this evidence, we believe that blocking the toxicity of [beta amyloid oligomers] is the most promising approach for the treatment of AD (Alzheimer’s disease), which led us to discover and develop ACU193,” Acumen said in the IPO filing.

ACU193 is a monoclonal antibody given as an intravenous infusion. The Acumen drug is designed to selectively bind to AbOs. While Biogen’s recently approved Aduhelm also targets AbOs as well as beta amyloid plaques, Acumen believes its drug could offer a safety advantage. Swelling in the brain and tiny spots of bleeding are among the side effect risks listed for the Biogen drug. Due to those risks, the FDA said that patients must undergo periodic brain imaging to check for these problems. Acumen said that its antibody has been engineered to reduce its effect on immune cells. It is also designed to avoid binding to amyloid on vascular cells. The company expects those features will reduce the incidence of problems associated with amyloid plaque-targeting therapies.

Acumen still needs to demonstrate its approach can work in humans. A Phase 1 clinical trial began in April, aiming to enroll 62 patients with mild dementia or mild cognitive impairment due to Alzheimer’s. In addition to evaluating the safety and tolerability of the drug, the study is also intended to demonstrate the mechanism of ACU193. Data are expected by the end of 2022.

Acumen incorporated in 1996 but ACU193 traces its origins to the labs of Merck, which in 2003 began the research that led up to the antibody. That year, Acumen began an R&D partnership with the pharmaceutical giant focusing on Alzheimer’s disease immunotherapies, according to the IPO filing. Though ACU193 emerged as the lead product candidate from that research, Merck opted to terminate the program in 2011 and turn its focus to a different drug candidate. Acumen then obtained the rights to the terminated research, including ACU193.

Acumen is, so far, a one-drug company and little happened with that one drug until relatively recently. In 2018, Acumen raised its first institutional funding, which revived the company’s research. Since then, Acumen had raised about $97.5 million before the IPO, according to the filing. The most recent cash infusion was $30 million raised in mid-June, the second tranche of a Series B round that closed its first tranche last November. RA Capital Management is Acumen’s largest shareholder, owning a 21.6% post-IPO stake, followed by PBM Capital Group at 11.4%, the filing shows.

At the end of the first quarter of this year, Acumen reported having $41.4 million in cash. That money, combined with the IPO proceeds, will fund clinical development of its Alzheimer’s drug. Acumen plans to spend $75 million to complete the Phase 1 test of ACU193. If that study is successful, the company plans to then advance to the Phase 2 portion of a planned Phase 2/3 study. Another $30 million is set aside for chemistry, manufacturing, and other R&D work. The company estimates that the cash will be enough to support the company through 2023.