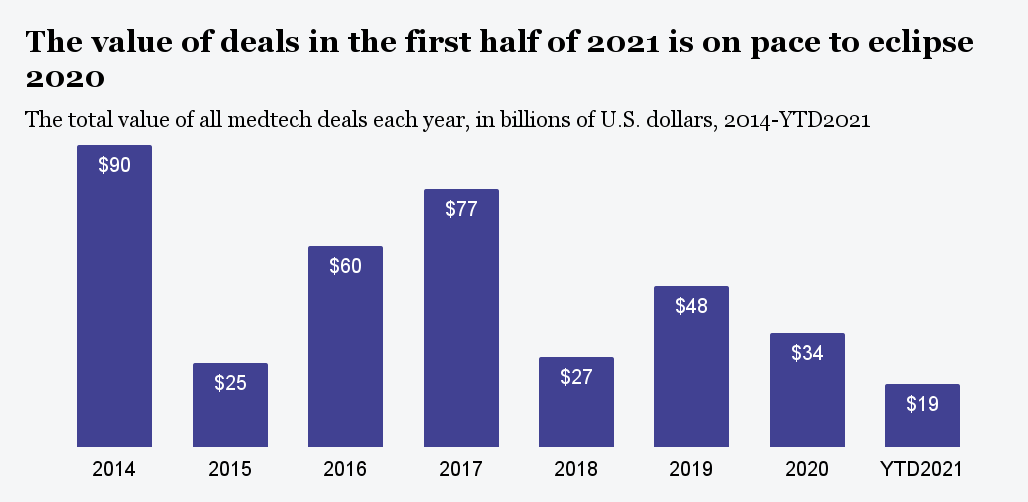

Medtech M&A took off in the first half of 2021, already eclipsing the number of deals made throughout 2020, and experts predict similar spending trends during the second half of this year.

Dealmaking started nearly as soon as 2021 began. Companies came out of the uncertainty of last year with large cash reserves and quickly put that money to work, with at least 10 deals announced in January alone.

While the pace of announced deals slowed from the break-neck speed of the first month of the year, multiple billion-dollar transactions and tuck-in acquisitions kept piling up. The medtech industry has recorded a total of 33 deals in the first half of 2021, up from 25 made in all of 2020, according to data provided to MedTech Dive by EY.

John Babitt, EY’s MedTech leader for the Americas, said companies were largely expected to tap into reserves built throughout 2020.

“We certainly got off to a very fast start,” Babitt said. “We’ve seen that activity taper off just a little bit from a velocity standpoint, but I’m pretty confident that we’re going to see pretty robust activity here in the second half as well.”

Jeff Haxer, a partner with Bain & Company, said companies were hesitant to spend money due to the effects of the pandemic, such as elective surgeries dramatically falling as hospitals filled with patients with COVID-19.

As elective surgeries slowly rebounded and the industry normalized, Haxer added, companies’ willingness to either buy up a competitor or be purchased as an asset also returned. That’s likely to continue.

“Based on the conversations we have, I don’t get a sense at all that they’re looking to slow down in Q2 or the back half of the year,” Haxer said.

Source: EY, Informa and Capital IQ

Scott Tuhy, lead medical device analyst for Moody’s Investor Service, said the diversity of deals made during the first six months of the year has been a noticeable trend, with M&A happening across multiple sectors.

“We’ve seen transactions in diagnostics, cardiology, dental,” Tuhy said. “There were certainly times in the past where deals were often focused on one sector, but what really just stood out is that we’ve seen such a broad array of transactions.”

Announced deals have ranged from strategic tuck-ins and spin offs to the buying spree in cardiac wearables and Steris’ $4.6 billion takeover of Cantel Medical.

Hologic and Boston Scientific were some of the most active buyers, announcing four and three deals, respectively. Hologic primarily focused on tuck-in acquisitions with three deals below $250 million, but the company did put up $795 million for Mobidiag.

Meanwhile, Boston Scientific had multiple deals in the billion-dollar range. The medtech dolled out $1.07 billion for Lumenis’ surgical business and $925 million for Preventice Solutions. The Preventice deal was part of a run on cardiac wearables makers, dating to December 2020 with Philips’ $2.8 billion purchase of BioTelemetry.

“Seeing all the cardiac monitoring deals was a little bit of a surprise … it was clearly a land grab, where people sought out their particular assets,” EY’s Babitt said. “We’ve seen that before in places like mitral valve and digital surgery a year ago … that was definitely a phenomena.”

Along with Boston Scientific and Philips, Hillrom stepped into the cardiac wearables space with its $375 million pick-up of Bardy Diagnostics. However, the company is trying to back out of the acquisition due to recent Medicare rate cuts for long-term cardiac monitoring.

Babitt said that while the cardiac wearables reimbursement saga has brought some near-term challenges, over the longer-term “remote monitoring is going to be a space for the future.”

Top medtech deals announced in the first half of 2021

| Date | Transaction | Deal amount |

|---|---|---|

| Jan. 12 | Steris to acquire Cantel Medical | $4.6 billion |

| March 15 | Roche to acquire GenMark Diagnostics | $1.8 billion |

| March 3 | Boston Scientific to acquire Lumenis’ surgical business from Baring Private Equity Asia | $1.07 billion |

| March 12 | Cardinal Health sells Cordis business to private equity firm Hellman and Friedman |

$1 billion |

| Jan. 21 | Boston Scientific to acquire Preventice Solutions | $925 million |

| April 8 | Hologic to acquire Mobidiag | $795 million |

| April 1 | Quest Diagnostics sells ownership in Q2 Solutions to IQVIA |

$760 million |

| Jan. 19 | Philips to acquire Capsule Technologies | $635 million |

| Jan. 7 | PerkinElmer to acquire Oxford Immunotec | $591 million |

| March 2 | Agilent to acquire Resolution Bioscience | $550 million |

| May 10 | Allergan Aesthetics to acquire Soliton | $550 million |

Diagnostics megadeal?

One trend experts highlighted during the first half was spending in the diagnostics space, fueled by revenues from COVID-19 testing businesses.

Hologic, for example, announced four deals in the first half totaling nearly $1.3 billion. Both Quest Diagnostics and LabCorp had deals in the first half, and Thermo Fisher, which grew 2020 revenue by 26% behind its COVID-19 business, spent $450 million for Mesa Biotech. The company also put up $17.4 billion for the clinical research company PPD and about $880 million for Novasep’s viral vector manufacturing business.

“There’s definitely some companies that for the most recent year and a half benefited from COVID diagnostic testing, and they generated a significant amount of cash flow that, in many cases, is still sitting on their balance sheet,” Tuhy said.

Companies like LabCorp, Quest, Thermo Fisher and Abbott Laboratories — although the later company has a much broader business base than traditional diagnostics — had some of the most cash and cash equivalents on their books at the end of the first quarter, according to MedTech Dive’s analysis of financial filings.

Medtechs have stockpiled billions in cash

| Company | Cash and cash equivalents |

|---|---|

| Abbott Laboratories | $8.05 billion |

| Thermo Fisher | $5.58 billion |

| Becton Dickinson | $3.73 billion |

| Medtronic | $3.59 billion |

| Stryker | $2.24 billion |

| Boston Scientific | $2.02 billion |

| LabCorp | $1.89 billion |

| Intuitive Surgical | $1.4 billion |

| Philips | $1.28 billion |

| Quest Diagnostics | $1.23 billion |

| Edwards Lifesciences | $1.17 billion |

| Quidel | $981.05 million |

| Hologic | $816.4 million |

| Qiagen | $787.79 million |

| Zimmer Biomet | $724.3 million |

SOURCE: Data taken from companies’ most recent 10-Q or 6-K Securities and Exchange Commission filings

As the diagnostics space grapples with plummeting COVID-19 testing revenues, M&A could be a way to replenish those losses.

“Now that testing is dying down, [diagnostic companies] almost assuredly are looking around saying, ‘What’s next?'” Haxer said.

Babitt, Tuhy and Haxer predicted more M&A activity in diagnostics during the second half. And while the majority of deals announced this year have been tuck-ins or around the $1 billion mark, the diagnostics space is where a mega-deal could take place.

“We’ll see if there’s a big mega-deal,” Haxer said. “Where it really wouldn’t surprise me would be, again, in those diagnostic companies. Some of them are so flush with cash, that it would not surprise me to see a big move there.”